Ethereum (CRYPTO: ETH) is trading near $4,100 on Friday, after a sharp selloff that followed its rejection from $4,700 and renewed fears of U.S. regulatory pressure targeting decentralized finance.

Ethereum Price Action Points To $3,800 Retest

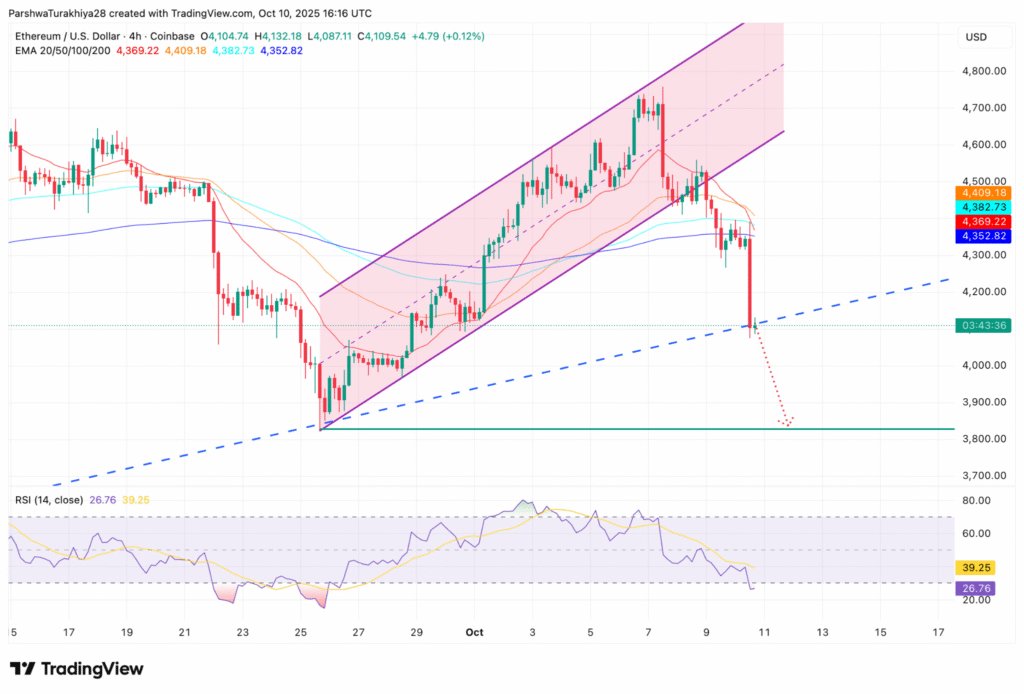

ETH Price Analysis (Source: TradingView)

Ethereum has fallen below its rising channel, signaling a clean breakdown after repeated rejections near $4,500.

The move pushed ETH under its 20-, 50-, and 100-day exponential moving averages, placing immediate support at $4,100.

Momentum favors sellers, and the price now hovers along an ascending trendline that connects June's breakout zone around $3,800.

Traders view this level as the next key test for bulls. If ETH fails to stabilize above $4,100, the path toward $3,800 becomes increasingly likely.

Bearish Indicators Flash As Ethereum Momentum Collapses

The 4-hour RSI sits near 27, deep in oversold territory, but still shows heavy bearish momentum.

A quick recovery above $4,350 would ease selling pressure, while a daily close under $4,100 opens the door for a retest of $3,800.

On the upside, only a decisive move through $4,500 would neutralize the bearish outlook.

On-Chain Data Confirms Heavy Ethereum Selling Pressure

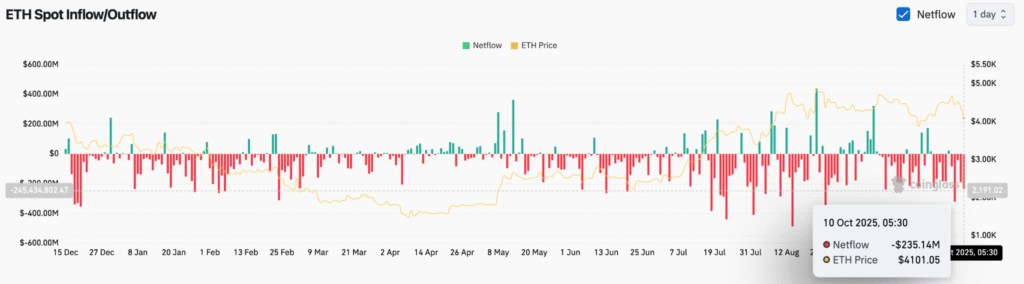

ETH Netflows (Source: Coinglass)

Data from Coinglass shows net outflows of $235 million on October 10, reflecting strong investor repositioning following Ethereum's recent rally.

Although outflows usually signal accumulation, this trend appears to align with profit-taking instead of new buying.

Since July, repeated outflow spikes have failed to generate lasting upside momentum, indicating weaker conviction among long-term holders.

This divergence between on-chain activity and price structure supports the bearish case in the near term, especially as ETH struggles to reclaim key support levels.

How Senate Democrats' DeFi Proposal Could Impact Ethereum

The Senate's proposed decentralized finance framework may not name Ethereum directly, but the network sits at the center of its implications.

Ethereum underpins most decentralized lending, trading, and stablecoin activity, making it highly exposed to any policy changes.

Under the proposal, individuals or teams providing front-end access to DeFi protocols would need to register as brokers with the SEC or CFTC.

That definition could extend to developers or teams managing interfaces for Ethereum-based protocols such as Uniswap (CRYPTO: UNI) or Aave (CRYPTO: AAVE).

If implemented, U.S. users could face restricted access, and developers might relocate operations offshore to avoid liability.

Stablecoins And Ethereum's Role In Global Settlement

Ethereum remains the dominant layer for dollar-pegged stablecoins such as USDT and USDC, which anchor over $250 billion in liquidity.

Reports from JPMorgan Chase & Co. and Standard Chartered Plc project over $1 trillion in stablecoin-related flows by 2027.

If U.S. policy limits how stablecoins interact with DeFi platforms, that demand could shift toward offshore markets or competing blockchains.

Meanwhile, Wall Street institutions like Goldman Sachs Group Inc. and Citigroup Inc. are building permissioned blockchain rails for internal settlements.

This creates a split between regulated bank-led systems and open networks like Ethereum that prioritize transparency and decentralization.

Why It Matters

Ethereum's fight for $3,800 is not just another technical retest, it is where market structure collides with politics.

The network carries the bulk of DeFi lending, stablecoin liquidity, and on-chain settlement -- precisely the areas Washington is moving to regulate.

If Ethereum loses this level while regulators advance restrictive frameworks, it could reshape how capital flows across decentralized rails.

This moment is less about one chart and more about whether Ethereum remains the backbone of open finance or cedes ground to permissioned blockchains led by Wall Street.

Read Next:

- Goldman Sachs, Citi, Bank Of America To Walk Through The Door Opened By Trump-Backed GENIUS Act

Image: Shutterstock