Today I'm writing about biotech portfolio construction, driven by our ongoing need to present clients with ideas offering substantial growth potential. This sector, centered on biotechnology and genetic engineering, stands out due to a significant rise in demand for innovative treatments. Modern technologies are now capable of addressing previously untreatable genetic disorders, replacing defective genes, and even performing genome edits at the cellular level, highlighting its critical importance.

Biotech Market Potential and Precedents

Regarding market potential, I see it following an exponential curve, with forecasts indicating that by 2030, gene therapies and genetic corrections will become more widely available, potentially unlocking hundreds of billions in revenue. A notable example is Novo Nordisk (NYSE:NVO) boosted by the FDA-approved Ozempic drug in 2017, has surged fourfold or more over five years, establishing it as a European capitalization leader. The companies I discuss today could repeat this success, possibly delivering pretty high returns over the next 3–5, or even 7 years (may be even 10 years).

Biotech Technology Overview

To set the stage, let's explore the technologies before delving into the companies and the portfolio I've picked. The first, CRISPR-Cas9 -- not such a usual name -- acts like precision scissors, cutting DNA at a targeted spot. Scientists program a guide molecule to pinpoint the genome section, while Cas9 makes the incision and inserts a new gene, allowing the cell to repair itself by either deactivating a faulty gene or adding a corrective fragment. This method is already approved and applied, notably for treating various anemias.

Next, Base Editing, an advancement of CRISPR, swaps a single DNA letter like a pencil, offering a safer approach by avoiding cuts, reducing error risks, and targeting diseases caused by single genetic mutations. Then, Prime Editing functions like a "find and replace" in Word, replacing genetic text segments without full cuts. It is capable of fixing up to 90% of known mutations, though it is still in clinical trials, with approval potentially sparking stock surges beyond Novo Nordisk's gains.

Another set, ex vivo and in vivo, includes ex vivo’s external process of extracting, editing, and returning patient cells--useful for blood stem cells but costly and complex--while in vivo delivers CRISPR medicine inside the body, already approved with its own pros and cons, positioning us close to treating many diseases. Traditional gene therapy, an older technique, inserts a working gene copy via a virus but faces challenges like immune responses and expense, with successes like Zolgensma in use for years. All these connect to pan-genome research, improving on the 2001 incomplete genome map with a universal version that enhances precise disease diagnosis and treatment outcomes.

Company Profiles

Turning to the companies biotech focused, I'll keep it brief given their number:

Eli Lilly (NYSE:LLY), a U.S. firm from the 19th century, targets diabetes, oncology, and neurology, has blockbuster drugs like Zepbound, boasts a $685 billion market cap.

Vertex Pharmaceuticals (NASDAQ:VRTX), founded in 1989 in the U.S., focuses on cystic fibrosis and genetic diseases with ex vivo therapies, generated $11 billion in 2024 revenues, and has a $120 billion valuation.

10X Genomics (NASDAQ:TXG), started in 2012 in the U.S., grew revenue from $3 million to $618 million by 2023.

CRISPR Therapeutics (NASDAQ:CRSP), a 2013 Swiss company, employs CRISPR-Cas9 with FDA-approved ex vivo therapy Casgevy in partnership with Vertex.

Beam Therapeutics (NASDAQ:BEAM), launched in 2017 in the U.S., uses Base Editing, collaborating with Pfizer.

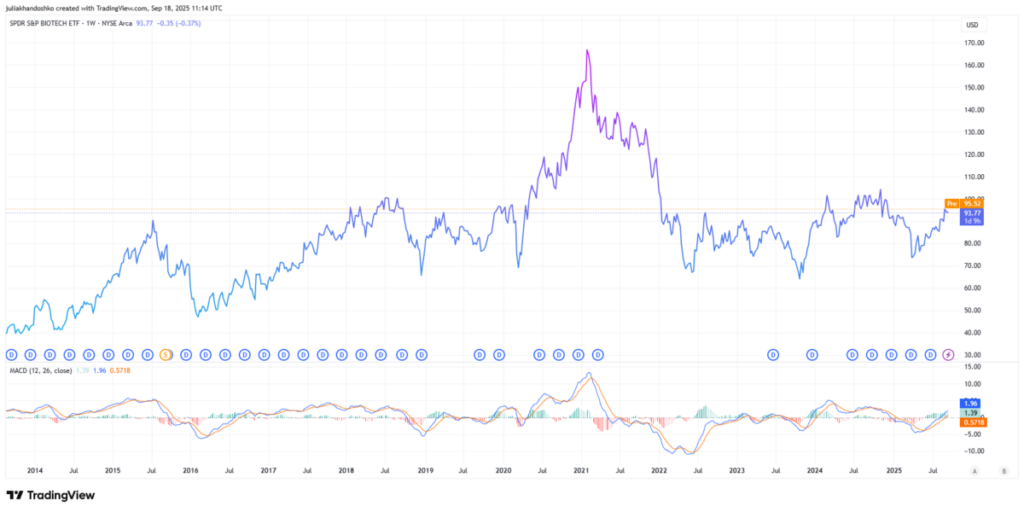

For the portfolio, the strategy hinges on a base of stable cash flows called "anchors"-established earners like Vertex, a cystic fibrosis pioneer, and Illumina (NASDAQ:ILMN), centered on genome editing, which provide a steady foundation with consistent revenue and lower volatility due to their mature business models.

Portfolio Composition

Building on this, the portfolio includes four growth "motors" poised for near-term gains, featuring technologies either approved and scaling or nearing approval for explosive growth: CRISPR Therapeutics, Intellia Therapeutics (NASDAQ:NTLA), Beam Therapeutics, and 10X Genomics, which drive industry progress with high pipeline potential, though current profits are modest as they undergo significant scaling.

The third tier, dubbed "options," comprises high-risk, high-reward stocks where success could yield 5x or 10x returns, including Prime Medicine (NASDAQ:PRME), Editas Medicine (NASDAQ:EDIT), which remain unprofitable with little revenue but could see massive growth if their technologies gain approval. The allocation breaks down with anchors at 30–35%, growth motors at 50% (up to 40%), and options at 10%, with an investment horizon of 3, 5, 7, or up to 10 years, reflecting the slow drug development cycle--technology adoption, approval, and commercialization can span a decade. Patience is essential, but the long-term results could prove highly rewarding.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.