NeoGenomics (NASDAQ:NEO) is in Phase 18, the final stage of its Adhishthana Cycle on the weekly charts. After more than 850 days of consolidation, the stock shows little sign of breaking out. When analysed under the lens of the Adhishthana Principles, NEO seems to have taken the blue pill, stuck in the Matrix of range-bound trading until August 2026.

NEO's Cycle So Far

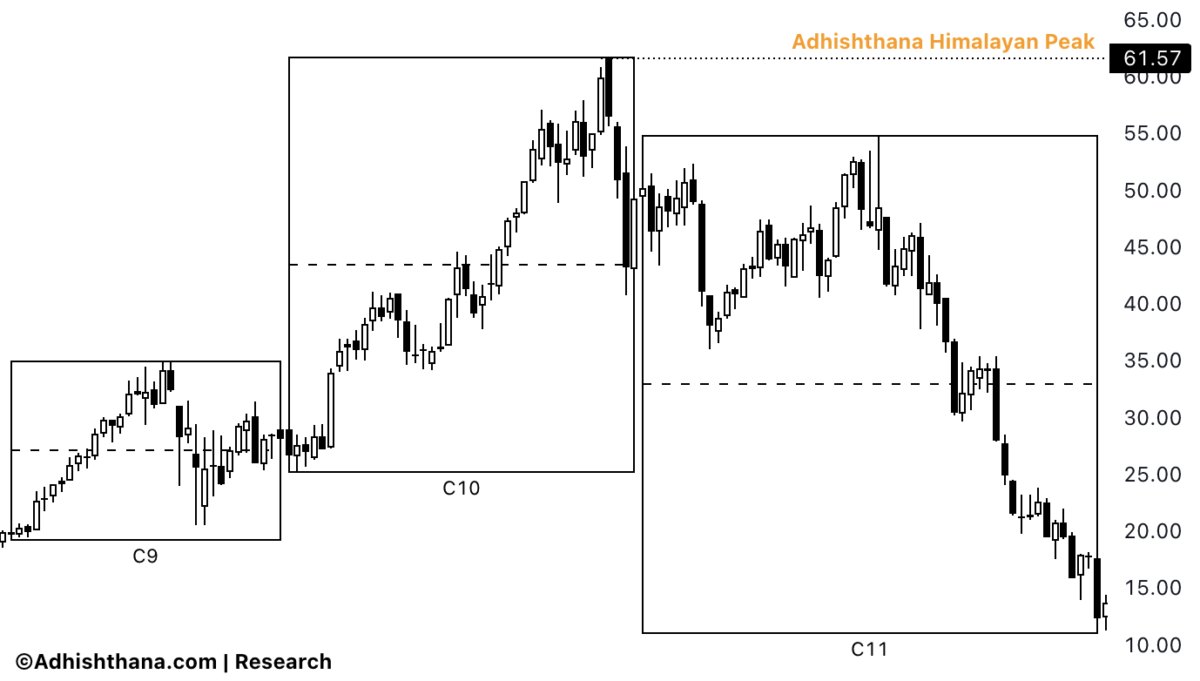

Throughout its cycle, NEO has aligned closely with the Adhishthana Principles, our proprietary model that blends behavioral archetypes with quantitative signals. One of the best examples of this was between Phases 9 and 12.

According to the framework, stocks in Phases 4 through 8 typically form a Cakra. This is a channel-like structure with an arc that often carries bullish implications. The breakout finally comes in Phase 9, which marks the start of the Himalayan Formation with strong bullish momentum.

NEO followed this path exactly. From May 2016 to September 2019, it traded within its Cakra. Then in Phase 9, the stock broke out sharply, rising from $18 to $34, marking the start of the Himalayan Formation. This three-leg sequence includes an ascent, a peak, and a final descent. The peak is most often formed in Phase 10.

NEO delivered in line with expectations, extending its rally in Phase 10 to reach $61. As I outlined in Adhishthana: The Principles That Govern Wealth, Time & Tragedy regarding peak formation in Phase 10:

"The 18th interval is expected to be the level of peak formation; if not, then the 23rd interval. If this phase concludes without forming the peak, it is anticipated to occur in the following phases."

The stock peaked in Phase 10 and began its descent. At the time, market indicators and analyst ratings were bullish, yet our signals had already turned red. The target for the descent leg is usually the Phase 9 breakout level, which for NEO was near $18. In line with this, the stock fell more than 70% and returned to its breakout origin, completing the Himalayan Formation.

What Went Wrong For NeoGenomics?

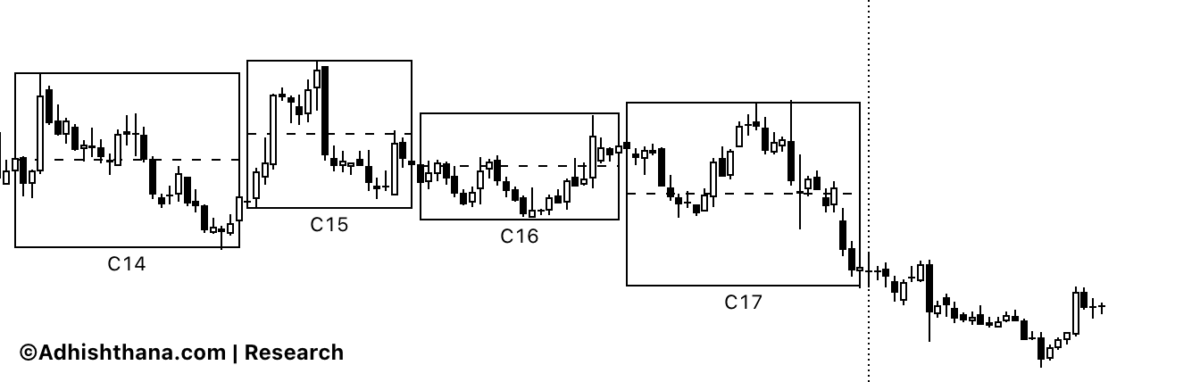

The problem for NEO started once it entered its Guna Triads. According to the principles, Phases 14, 15, and 16 collectively form the Guna Triads. These determine whether a stock can achieve Nirvana in Phase 18, the highest point of its cycle.

For Nirvana to occur, the triads must show Satoguna, which is a clean and sustainable bullish move. For NEO, there was no such sign across the triads. The stock failed to build bullish momentum, and this made it clear that Nirvana would not take shape in Phase 18.

This is exactly what has played out. The stock continues to consolidate in Phase 18 and has stayed range-bound for more than 850 days. The phase concludes only in August 2026, which means the slump may continue for some time.

Investor Outlook

NEO had a strong run during its Himalayan Formation, but with weak Guna Triads in place, the stock is locked in consolidation through August 2026. Investors considering a position may want to wait, as the stock is unlikely to show meaningful movement in the near term.

NeoGenomics appears to be stuck in the Matrix, and for now, it has chosen the blue pill.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.